In today’s market, companies can no longer depend solely on cash and checks. Most everyone has a credit card, and most people use their cards for everyday transactions. Although setting up this payment method may seem daunting and may take some time, the financial rewards outweigh any the initial start-up stress. Credit repair businesses should accept credit card payments, and here’s why:

It legitimizes your business.

Credit repair businesses are working against some (often unfounded) stereotypes regarding the industry’s legitimacy and efficacy. Although the industry is making great strides in clearing the name of “Credit Repair,” professionals must strive to project a strong, viable, and legitimized business to counter any initial doubts that consumers may have. A consumer might see a red flag if they are considering a company that deals only with cash and checks. By accepting credit cards, you assure your clients that you have means to compete with other companies. Most LLCs and corporations accept this method of payment, and it authenticates their businesses.

Accepting credit cards will increase your sales.

Your clientele will expand once you accept all payment methods. It’s quite easy for a customer to pay with a credit or debit card, and this is enticing to consumers who want to accomplish things quickly and efficiently. You business will be able to process more customers, and your customer-base will widen.

You’ll be competitive with other credit repair businesses.

Credit repair is a growing industry, and you need to compete on every level of your business accounts. Payment methods is one aspect of business operations that should be comparable with other major competitors. Why? Because consumers are going to assume that the business that accepts credit cards is more legitimate and they know everything will be processed faster.

Credit cards allow consumers to buy more.

With a credit card, customers can add more to their purchases on a whim, rather than having to budget the specific amount of cash they have on them. It’s easier to sell to someone with a credit card, because they most likely are able to make extra purchases without having to run to the ATM.

It will expedite your cash flow, and keep your office safer.

Credit card transactions process relatively quickly. You won’t have to wait for checks to clear, and you won’t have to make daily deposits to the bank. Additionally, the less cash you have on you, the better. Although your office might conduct some cash transactions, if you accept card payments you’ll most likely keep less cash in the office, which is safer for you and your employees.

If you’re conducting any business online, accepting credit cards is a necessity.

You must accept credit cards if you’re seeking to make transactions on the Internet. To maintain a viable, competitive company, you will need some form of an online business – and you will need to accept card transactions to stay competitive.

Accepting credit cards eliminates the risk of accepting a bad check.

If you only accept cash and checks, you will inevitably encounter a bad check. A bounced check will set you back and it will cost you in time spent correcting the issue. This process is never fun, and it’s always time-consuming. Credit card transactions are screened as they are processed to prevent a failed payment attempt.

Accepting credit cards is not as costly as you think.

As a business expense, accepting credit cards is relatively inexpensive. Any set-up costs will be offset by the financial gains made with the ease of card transactions. Credit card processing is a competitive industry, so no rate should break your budget. Make sure you’re up-to-date on the ins-and-outs of merchant accounts before you begin shopping around.

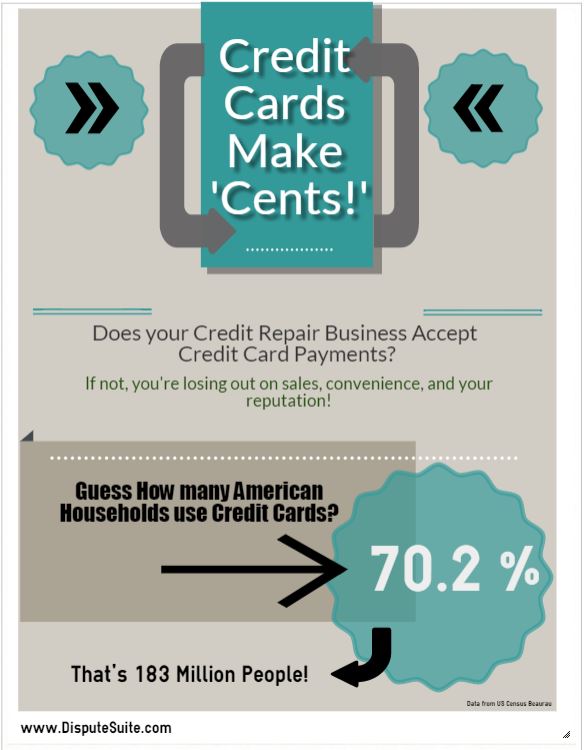

Almost all American households use credit.

According the US Census , 70.2% of all American Households possess and use credit cards. That equals out to be 183 Million people! Most Americans feel inconvenienced when forced to pay with alternative methods of payment. Credit Repair can be uncomfortable enough for your customers. Make it easy on them… and you!

Ready to enhance your business and increase your cash flow? Talk to the industry’s best professionals about the easiest and most cost-effective business plan. Call Dispute Suite today to learn more: 727-877-6812 or visit www.DisputeSuite.com