Growing credit repair companies need to be aware of the process and timespan of setting up merchant accounts. But first – business owners needs to understand the merits and necessity of a merchant account.

A credit repair business will be less profitable and less marketable if it only accepts cash and checks. Credit cards will allow you to expand your customer base and provide a more convenient method of payment than cash or checks. Businesses and everyday individuals no longer deal solely with these dated methods of payment; you will need a way to accept credit cards to remain a viable and a competitive credit repair business. Most importantly, if you are interested in selling credit repair over the Internet, accepting credit cards is a must. Here’s what you need to know…

Merchant Accounts

If you want to accept credit cards, you will need to open a merchant account. A merchant is usually a bank who will take the money directly from your client’s credit card company (Visa, MC, AMEX, etc.) and deposit it into your bank account. For this service, you often have to pay a “transaction fee,” typically a percentage of the sale. This is where the selection process starts.

Can Anyone Get A Merchant Account?

The answer is NO. The approval processing team will review several factors, including proposed sales forecast, your credit history, and the industry itself. Those with poor credit history will find it especially difficult. Another potential problem concerns what particular industry you are in. Unfortunately, the term “credit repair” often rings fear in some companies, so you may find out when you apply for some merchant accounts that you will be declined based solely on your industry. This happens because the merchant is worried about “chargebacks.” These occur when a consumer disputes a charge and the merchant refunds it. However, don’t lose faith. There are plenty of merchants that approve credit repair businesses.

How To Locate A Merchant Account

Since Credit Repair is considered a “High Risk” industry, there are only a handful of banks or providers that allow credit repair companies to be approved for merchant accounts. We have a few options that can point you in the right direction, as listed below. If you have any questions about these services, click the links and complete the forms so these companies can provide you with more information.

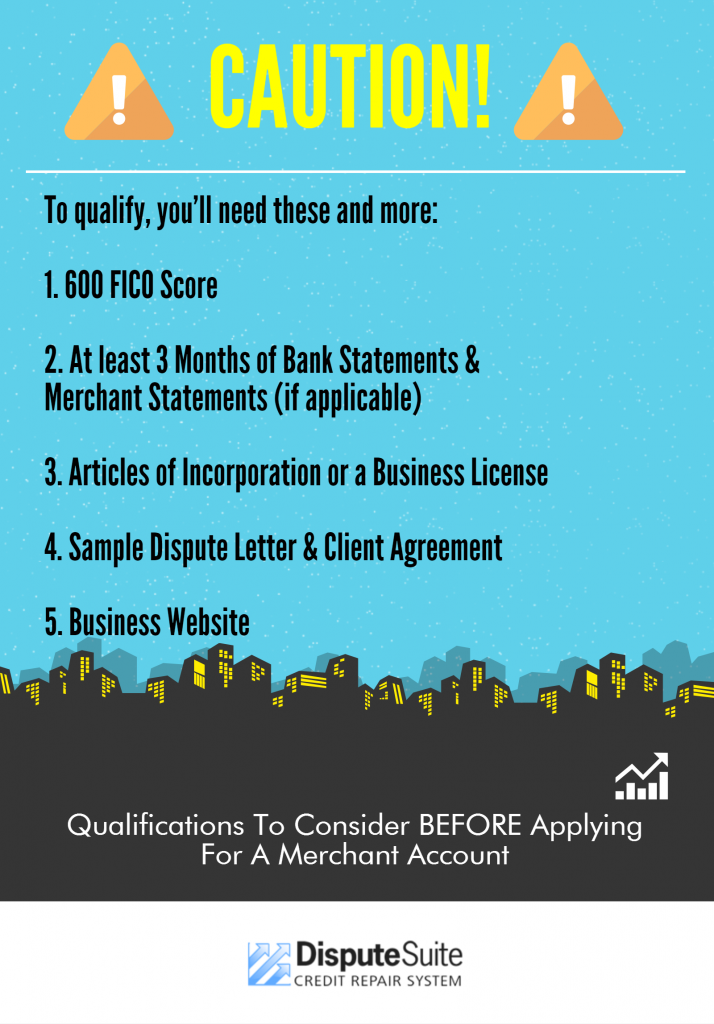

Here’s an example of the requirements for most merchant account companies:

Credit Requirement: Must have a credit score above 600 FICO (Not all merchant accounts require this). If your credit is not above 600, you can have a Co-Signor. (Must be a business owner, partner, spouse and/or Parent of the principals.) NOTE-Sparrow does not require a 600+ FICO score.

Other requirements:

- 3 Months Merchant Statements (If applicable)

- 3 Months Bank Statements (Personal or Business)

- Articles of Incorporation or Business License(s).

- A sample letter that you send to the Credit Bureaus, or the letter explaining the process you use to increase your client’s credit score.

- Website URL (Your website can only offer “Credit Repair” – loan modification, identity theft, & debt settlement/negotiations services cannot be listed on your same site). Your website must display service description, pricing, refund or cancellation policy, privacy statement and contact info, address and phone number.

- You will need to provide a sample of the agreement your customer signs. The copy of the agreement your customer signs should have the service description, pricing, refund or cancellation policy, privacy statement and contact info, address and phone number.

- You must agree to use this merchant account for “Credit Repair” services ONLY. (Nothing Else)

- You must agree to never use your own credit cards on your merchant account. (Not even for testing purposes)

- You must agree to always give immediate refunds to anyone who requests to avoid chargebacks. (Your account will be closely monitored for this)

Merchant accounts take time. However, it is a necessary component of a successful credit repair company. This is a risky and sometimes complicated aspect of business development; make sure you talk to the right professionals in the right industry for the right information. Call Dispute Suite today! 877-907-8483 or visit us online at www.DisputeSuite.com for more information.

P.S. DisputeSuite provides a variety of solutions for your credit repair business. From engaging custom websites, to dispute processing services, to a robust CRM with automations and portals, DisputeSuite is a One-Stop Shop to making your Credit Repair Business A Success! Let’s chat today to discover the best plan for you: 727-877-6812 or support@disputesuite.com

FREE WEEKLY WEBINARS! Register here to join us weekly to hear industry updates, expert speakers and business tips & tricks!