Running a credit repair business is extremely time consuming. Many people are aware of the option of automating their business, and the desire to do so makes sense: you’ll have to work less on smaller items, which frees up to your time to make more sales and expand your business’s client and profitability margins. Having a business that virtually runs on autopilot is an understandable desire, and it’s a possibility in the credit repair field.

In order to automate your credit repair business and alleviate your workload, you need to choose a software system specifically designed for the industry. To choose the right software, consider which jobs and tasks take the most time during your work hours.

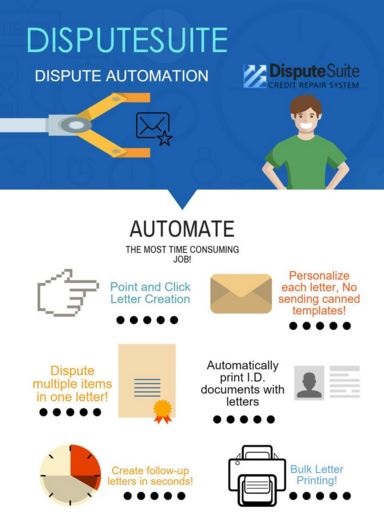

Once you have taken inventory of the tasks that take up the most of your time, you can assess your business’s software needs. For many credit repair business owners, the most time-consuming task is generating and sending dispute letters. Even if you have a template for every possible situation, the time it takes to input your customer’s information could take hours out of your day. If your credit repair business has the finances to hire a full-time staff member, then it may not take time out of your day, but it can still cost a lot to keep that person employed. A good credit repair software can eliminate your need to hire additional staff, by automating the dispute process and allowing you to customize and create tailored dispute letters, as well as track and record disputes in a fraction of the time. Many software companies offer the possibility of automating the dispute process. Some companies, like DisputeSuite, offer this option in addition to the opportunity to outsource your processing needs. As with every business, you need to evaluate how it operates, and assess whether disputing on your own is really the most cost effective option.

Another time consuming, but extremely important task is the act of generating new business. Your sales team loses valuable first-contact and follow-up call time when they are all working on the same leads. If multiple sales people are contacting the same leads, that means there are leads out there that aren’t getting calls or follow-ups from any of the reps in your credit repair business. Additionally, potential prospects will not like the idea of being contacted from several different people in your sales department – this indicates business oversight and the customer could take their business elsewhere. A great credit repair software can help create and manage credit repair business opportunities by allowing sales reps to track, share and manage leads. When deciding on which software to use, make sure the software will help you drive sales performance, tracks prospects and routes qualified leads to the right sales people.

To increase the efficiency of your business, outsource certain tasks to credit repair software that can slash your time to complete necessary tasks in half. For the most important elements of your business, use credit repair software that makes the tasks easier for your employees and allows them to work together to keep the business organized.

There are many options for credit repair professionals – but you want to invest in a software system that optimizes your business’s performance. DisputeSuite is consistently lauded for their software’s user experience and the many features tailored specifically for credit repair.

Don’t waste money on the wrong software.

Contact DisputeSuite today and speak with software experts: Call 727-877-6812 or visit www.DisputeSuite.com.