Do FICO® Scores Confuse HELOCs with Credit Cards?

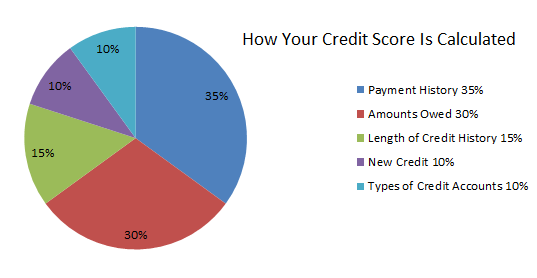

Credit card utilization, aka “revolving utilization”, is one of the most predictive, andtherefore valuable, measurements in the FICO credit scoring system. In fact, it’s a majorcomponent of FICO’s “Debt Usage” category of characteristics, which is worth 30% ofthe points in your FICO score. The higher your utilization, the ratio of balances to creditlimits, the lower […]

Do FICO® Scores Confuse HELOCs with Credit Cards? Read More »