Our FICO credit scores are calculated over 10 billion times each year and used for

lending and insurance decisions. In fact, except when you’re applying for a job, it’s

difficult to NOT have important decisions influenced by our FICO scores. In this article

I’m going to answer some very basic questions about the ubiquitous FICO score.

Why does it matter? – It’s hard to find a lender who doesn’t use the FICO score as partof their risk management practices. According to FICO, the top 50 U.S banks and the

top 25 U.S credit card issuers and auto lenders use the FICO score. Point being, if you

want a loan for just about anything you need to pay serious attention to your FICO score.

I’ve heard mortgage lenders pull all three of my FICO scores – This is true but it’snot voluntary. Fannie Mae and Freddie Mac have mandated that any mortgage lender

who sells loans to them pull all three of your credit reports, all three of your FICO scores

and then use the middle score for underwriting. This is a conservative approach to

lending.

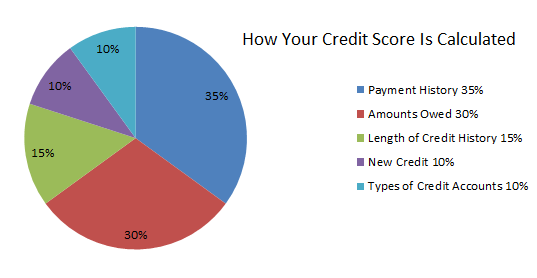

How does my credit report influence my score? – The FICO score is a “credit

bureau” score, which means that the ONLY information that influences the score is

data from your credit reports. The information on your credit reports included in your

score falls neatly into 5 categories; payment history, indebtedness, age of credit history,

inquiries, and account diversity. Payment history and indebtedness account for 65% of

the points in your score. The remaining categories account for 35% collectively.

How do insurance companies use FICO scores? – Insurance companies use FICOscores but they aren’t the dominant score in that market, as they are in the financial

services market. The LexisNexis Attract score is the dominant score in the insurance

market. Regardless, the scores are used for the same purpose, which is to assess the

risk of an insurance company doing business with a consumer. If your risk of filing a

claim or causing a loss to the insurance company is too great then they will either deny

coverage or change a higher premium to subsidize their risk.

“The Credit Guru”, Longtime FICO Insider & Credit Industry Authority President Of The Ulzheimer Group, LLC

John Ulzheimer is a nationally recognized expert on credit reporting, credit scoring and identity theft. He is the President of The Ulzheimer Group, the Director of Credit Education at DisputeSuite.com, Credit Expert at CreditSesame.com and the credit blogger for Mint.com. Formerly of FICO, Equifax and Credit.com, John is the only recognized credit expert who actually comes from the credit industry. He has served as a credit expert witness in more than 150 cases and has been qualified to testify in both Federal and State court on the topic of consumer credit.