What happens when you dispute a charge on your credit card or discover a billing error? Here are the basics:

First, your complaint or dispute must be sent to the address that the creditor provides for billing inquiries. Your creditor must reach the creditor within 60 days of the date of the bill containing the error or fraudulent charge. The letter should be mailed by traceable means.

The creditor must acknowledge within 30 days that they have received your complaint. The creditor should then resolve the dispute within 2 billing cycles, or less than 90 days. The creditor should also explain any actions they took to correct the error, or explain why they believe there was no error.

As the card user, you can withhold payment of the disputed amount and pay only the parts of the bill that are not in dispute. Most credit card companies facilitate this by issuing a temporary credit while your complaint is being investigated.

If the creditor can prove there is no error, then they can then collect finance charges on the disputed amount.

For more information about your credit card billing rights, see the FCBA (Fair Credit Billing Act) at:

http://www.consumer.ftc.gov/articles/0219-fair-credit-billing

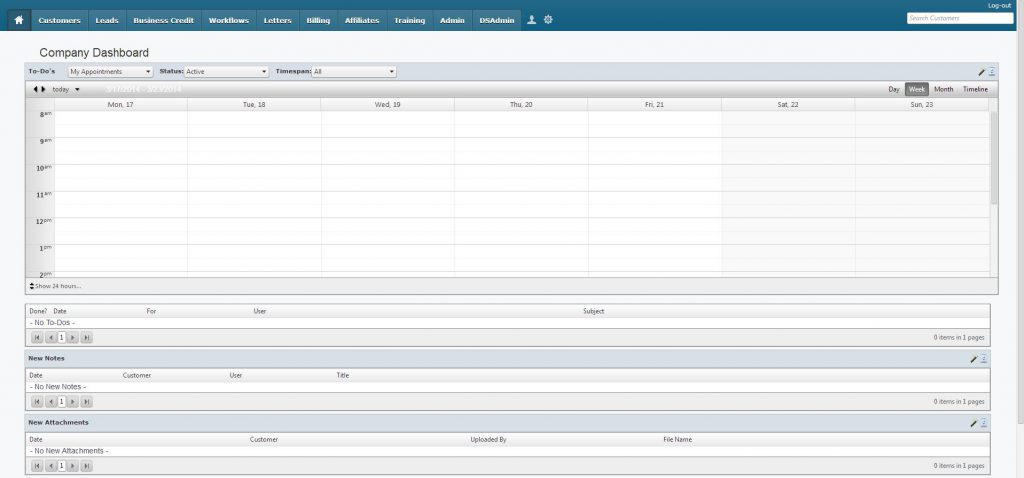

P.S. DisputeSuite provides a variety of solutions for your credit repair business. From engaging custom websites, to dispute processing services, to a robust CRM with automations and portals, DisputeSuite is a One-Stop Shop to making your Credit Repair Business A Success!

Let’s chat today to discover the best plan for you: 727-877-6812 or support@disputesuite.com

FREE WEEKLY WEBINARS! Register here to join us weekly to hear industry updates, expert speakers and business tips & tricks!