A personal loan is an unsecured installment loan offered by most large and small

banks. They went out of favor in the middle of the credit meltdown but have made a

very impressive comeback. Many large banks, in fact, will now go as high as $100,000

if you’ve got good enough credit and sufficient income. Personal loans, also known

as “signature loans”, also have another lesser known benefit…they can significantly

improve your FICO scores very quickly.

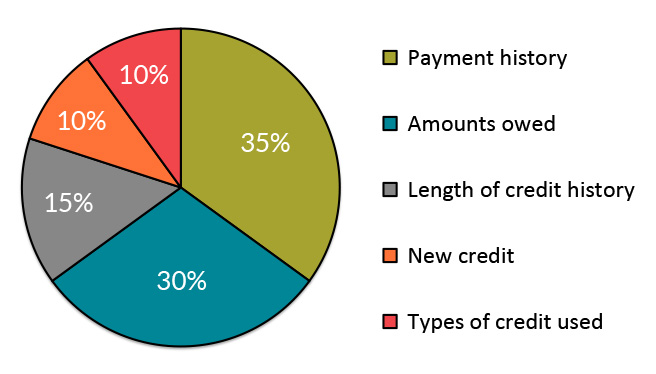

One of most actionable ways to improve your FICO scores is to reduce or eliminate

credit card debt. The reduction in your credit card utilization ratio and the elimination of

accounts with balances can result in triple digit score increases within 30 days. This is

where the personal loan can play a huge part in your score improvement strategies.

Personal loans are often used to pay off credit card debt. The result can be a lowerinterest rate, which is great but isn’t going to help your credit scores one bit. The real

score based value of paying off credit card debt with a personal loan is the conversion of

revolving debt to installment debt.

Installment debt isn’t factored into the debt utilization ratio because it’s a credit card only

measurement. That means the minute you move your credit card debt over to personal

loan debt your utilization percentage will go down, despite the fact that you still have

the same exact amount of debt. And, if you eliminate more two or more credit card

balances, you’ll net out ahead. And, if you eliminate more then two, well that’s just gravy

for your credit scores. Just don’t make the mistake of closing credit cards that have been

paid off.

So the next time you’re looking at ways to increase your FICO scores consider the

personal loan option. They’re relatively easy to get and the benefit to your scores is

measurably significant and lightening fast.

“The Credit Guru“, Longtime FICO Insider & Credit Industry Authority President Of The Ulzheimer Group, LLC

John Ulzheimer is a nationally recognized expert on credit reporting, credit scoring and identity theft. He is the President of The Ulzheimer Group, the Director of Credit Education at DisputeSuite.com, Credit Expert at CreditSesame.com and the credit blogger for Mint.com. Formerly of FICO, Equifax and Credit.com, John is the only recognized credit expert who actually comes from the credit industry. He has served as a credit expert witness in more than 150 cases and has been qualified to testify in both Federal and State court on the topic of consumer credit.

P.S. DisputeSuite provides a variety of solutions for your credit repair business. From engaging custom websites, to dispute processing services, to a robust CRM with automations and portals, DisputeSuite is a One-Stop Shop to making your Credit Repair Business A Success! Let’s chat today to discover the best plan for you: 727-877-6812 or support@disputesuite.com

FREE WEEKLY WEBINARS! Register here to join us weekly to hear industry updates, expert speakers and business tips & tricks!