Advanced Credit Course

Take This Quick Test & See How Much You REALLY Know About Your Credit Repair Business

Your Answers Might Reveal Critical “Knowledge Gaps” (You can also learn how to cure them once and for all!)

Nobody needs to tell you that being in the Credit Repair Business is both challenging and rewarding. You can get started by studying the basics and you might get some success with clients.

But are you limited or even endangered by what you don’t know? Take a few minutes and check your in-depth knowledge of Credit Repair Tactics, Techniques, Pitfalls and Marketing tools.

Do you know...

- If removing a negative item can actually lower your client’s credit score?

- All the different ways a Credit Reporting Agency can stall your disputes and how you should respond to each?

- What is the “Update Audit Technique” and how does it work?

- What is the “5-Point Checklist” you must adhere to in order to avoid having your disputes rejected?

- Why are “Indirect Dispute Techniques” so powerful? And why are they so controversial?

- There are over 8 different strategies you can use when your client’s dispute comes back as “verified”? How many of them do you know?

- What is the “K.O. Method” for deleting collections? When should you use it and why does it work so darn well when used properly?

- What are the three ways subprime merchandise cards can help your client?

- What are the two mistakes you never want to make when advertising your credit repair services?

- What are the three most critical factors you should consider when considering a “referral partner”?

Did You Sail Through This... Or Was It A “Wake-Up Call”?

What areas do you Still need to master to be at the top of your game?

What if you could have at your disposal...

- Not ten, fifteen or twenty, but SIXTY Separate Credit Repair Tactics And Letters in a Comprehensive “Credit Dispute Library” – With these at your fingertips, you’ll never ever run out of hard-hitting tactics for every dispute.

- 142 Sample Dispute Letters – Get precise wording that completely eliminates any misunderstanding of your case facts or the nature of your request.

- Complete Contact Information on Every Major CRA Office and Check Reporting Agency – Don’t waste valuable time searching for hard-to-find contact information, it’s all here.

- A Complete 123-Page Guide For Operating, Organizing And Marketing “Your Credit Repair Business” – Includes expert insider information on how to triple your marketing reach for pennies with the latest website and internet advertising tools.

- Complete details about consumers’ legal rights and what to do when a creditor or collector violates the law – You MUST know when the law is on your side so you’ll get the exact wording of all applicable laws.

- 537 Study Questions Plus Answers in a Separate Volume –Use this comprehensive assessment tool for evaluating new employees to see how much they really know.

- Even more important: What you may and MAY NOT DO under the law. – You can avoid the unscrupulous behavior that gives Credit Repair a bad name and could ruin your business.

You can, starting right now.

Because All of This And Much More is Contained in

The Most Comprehensive Course Ever Compiled for Professionals in The Credit Repair Industry

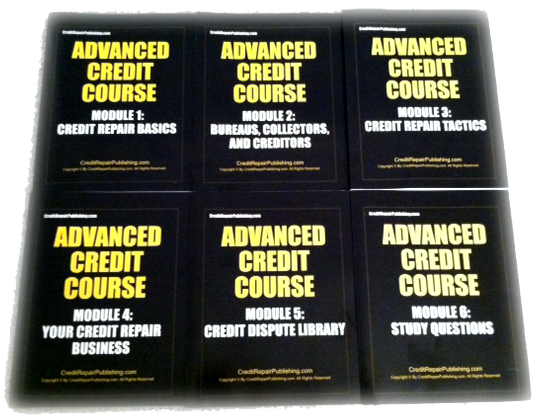

“THE ADVANCED CREDIT COURSE”

Because the more you know, the better you are and the better you are the more you will make in your business

So How Much Are These Strategies, This Massive 6 Volume Course,

These Bonuses and The Templates Worth To You?

See, at this price, it only takes one bullet point, one sentence, one letter, or one selling point to turn a tough case into a success and to make that client a life long satisfied customer and referral source.

PLEASE NOTE: The course described below is NOT a beginner’s how-to course. As the name implies it is a course of advanced study for professionals who are in the credit repair business. The tactics and information contained in this course will be extremely useful to those who already have some experience working with CRAs and disputing erroneous credit report information.

The ADVANCED CREDIT COURSE is Over 900 Pages of Professional Training In Easy to Use Workbooks That Give You Everything and Leaves Out Nothing.

This course will...

- Exponentially Expand the Depth of Your Credit Repair Skills

- Triple Your Tactical Response Repertoire

- Complete Your Understanding All The Applicable Laws

- Steer You Away From Questionable and Risky Tactics

- Answer ALL Your Questions about What Works & What Doesn’t

- Model What It Is To Be A True Professional

- Provide Actionable Marketing & Business Promotion Ideas

Your Best Protection Against Bad Advice

Compiled by the nation’s foremost experts in the credit repair field, every page is written from the viewpoint of professionals who have been in the trenches and done battle for years – true professionals whose ethics and standards are above reproach. There are no shortcuts and The Advanced Credit Course pulls no punches in telling you that SOME courses and SOME instructors give you BAD ADVICE!

“They” may tell you,

- Keep sending the same dispute letter again and again.

- Dispute every erroneous item on a credit report.

- Do not use a tactic because if it didn’t work for someone else.

- Sending a dispute by email is the same as sending a letter.

- When you do send a letter, use plain white paper with your company name and address printed at the top.

ALL OF THIS IS BAD ADVICE! Do Not Take Bad Advice and endanger your Credit Repair career.

You’ll learn the Right Things to Do in the Advanced Credit Course.

Do you know it all, or enough to be dangerous? Let’s find out by looking at each volume in the course.

How much do you know about Credit Repair Basics?

Here are a just a few important questions that are answered in Module 1 of the 6-Volume course.

This course will...

- Factual Disputes: What are they? Why are they so powerful? Why do so few use them and how many ways can they be constructed? Important facts on page 37

- What are the “7 Points” to prioritizing your clients derogatory items and why is it so important? Page 75

- It’s one of the “deadliest” mistakes you can ever make in credit repair but it costs you ZERO money and effort to avoid it (explained in one paragraph on page 14)

- What are the “three keys” of credit repair you should share with every new client. page 35

- “Metro 2 File Format”, “Matching Algorithms” and “Partial Data Matches”. A true Credit Professional knows all these terms… but you’ll master them in one evening after turning to page 19

- What is an E-Oscar code? How many are there and how do they affect your disputing approach? Important information is on page 27.

- Why sending a dispute letter labeled “not mine” is not only stupid (but dangerous) for the following four reasons found on page 34

- Why is it possible to obtain a 700+ credit score only two years after bankruptcy? The secret is revealed on page 49

- What is the “eight point hierarchy of impact” with regards to negative items and how can it help you? Page 50.

- What are the three criteria every dispute must be based upon? They’re on Page 57

These are just a fraction of what you’ll find in this fact-rich First Volume of the Advanced Credit Course. Every page is $$ in your pocket when you read and remember all the ways to break down the walls of resistance and wow your customers with your disputing skills.

Module One -- Credit Repair Basics $199 Value

There’s only one place to find the answers to questions like these plus many more invaluable facts, tips and essential information about Credit Repair Basics. This is information you MUST KNOW if you’re going to do the best job possible for your clients. It’s all contained in The Advanced Credit Course.

How much do you know about Credit Repair Basics?

This course will...

- Factual Disputes: What are they? Why are they so powerful? Why do so few use them and how many ways can they be constructed? Important facts on page 37

- What are the “7 Points” to prioritizing your clients derogatory items and why is it so important? Page 75

- It’s one of the “deadliest” mistakes you can ever make in credit repair but it costs you ZERO money and effort to avoid it (explained in one paragraph on page 14)

- What are the “three keys” of credit repair you should share with every new client. page 35

- “Metro 2 File Format”, “Matching Algorithms” and “Partial Data Matches”. A true Credit Professional knows all these terms… but you’ll master them in one evening after turning to page 19

- What is an E-Oscar code? How many are there and how do they affect your disputing approach? Important information is on page 27.

- Why sending a dispute letter labeled “not mine” is not only stupid (but dangerous) for the following four reasons found on page 34

- Why is it possible to obtain a 700+ credit score only two years after bankruptcy? The secret is revealed on page 49

- What is the “eight point hierarchy of impact” with regards to negative items and how can it help you? Page 50.

- What are the three criteria every dispute must be based upon? They’re on Page 57

These are just a fraction of what you’ll find in this fact-rich First Volume of the Advanced Credit Course. Every page is $$ in your pocket when you read and remember all the ways to break down the walls of resistance and wow your customers with your disputing skills.

Module One -- Credit Repair Basics $199 Value

Module One -- Credit Repair Basics $199 Value

There’s only one place to find the answers to questions like these plus many more invaluable facts, tips and essential information about Credit Repair Basics. This is information you MUST KNOW if you’re going to do the best job possible for your clients. It’s all contained in The Advanced Credit Course.

We’re Just Getting Started!

Module 2 is Your Complete Guide To Credit Bureaus, Collectors And Creditors—118 Pages of MUST-HAVE Insider Information You’ll Be Reading and Referring to Again And Again.

The adage "Know your enemy" applies here. The more you know about their tactics, their systems, their practices and their ways of stacking the deck against your client, the more you will be prepared to deal with them successfully. It's a game of moves and counter moves.

If You’re Not 100% Up To Speed On Any Of These Vital Subject Areas THIS Is Where The Pros Go For Answers To Questions Like These…

- Not ten, fifteen or twenty, but SIXTY Separate Credit Repair Tactics And Letters in a Comprehensive “Credit Dispute Library” – With these at your fingertips, you’ll never ever run out of hard-hitting tactics for every dispute.

- 142 Sample Dispute Letters – Get precise wording that completely eliminates any misunderstanding of your case facts or the nature of your request.

- Complete Contact Information on Every Major CRA Office and Check Reporting Agency – Don’t waste valuable time searching for hard-to-find contact information, it’s all here.

- A Complete 123-Page Guide For Operating, Organizing And Marketing “Your Credit Repair Business” – Includes expert insider information on how to triple your marketing reach for pennies with the latest website and internet advertising tools.

- Complete details about consumers’ legal rights and what to do when a creditor or collector violates the law – You MUST know when the law is on your side so you’ll get the exact wording of all applicable laws.

- Even more important: What you may and MAY NOT DO under the law. – You can avoid the unscrupulous behavior that gives Credit Repair a bad name and could ruin your business.

- If a dispute is deemed frivolous what are first three things you should do to keep the dispute moving forward? Page 14

- If your disputes are being ignored by the credit bureaus what are the first three actions you should think about taking? Find them on Page 26.

- Why should you get excited every time you catch the credit bureaus violating your client’s rights within the dispute process? Page 32

- What are the four main tools available to collectors and why is doing a “cease and desist” complete suicide if done the wrong way? Page 41

- What is the “8-Point Checklist” for building a context for a collection account and why is it so important this step is not skipped over? Page 44

- Under the FDCPA collectors are required by law to provide a consumer with written notice containing specific information regarding the consumer’s right WITHIN 5 DAYS of the “initial communication” in connection with any debt. How do you capitalize on this fact? See page 51

- There are over 26 ways to catch collection agencies violating the FDCPA in order to help your client get massive leverage; how many of them do you know? Page 58

- What is the “K.O. Method” for deleting collections? When should you use it and why does it work so darn well when used properly? Page 86

- What are the two most important things to know about “direct disputing” and how it applies to other tactics you can use to help your client? Page 106

Module Two - Credit Reporting Agencies, Collectors and Creditors $199 Value

MODULE 3:

When young men go to West Point to become Army officers, they study the great battles fought throughout history by generals ranging from Napoleon to Norman Schwarzkopf.They study to learn TACTICS THAT LEAD TO VICTORY.

This is exactly what you’ll find in Module 3 – “Credit Repair Tactics” your 253-Page compendium of WHAT WORKS and leads to victory.

This one book alone should be in the office of every credit repair professional working today. Why? Because No One Method works every time, so you need to know them ALL. And, you need tactics for every unique and special situation you could encounter.

Just a few of the features you’ll find in Module 3:

Time Saving Tags: Each tactical description is conveniently tagged to show which entity it applies to whether it’s

- Credit Bureaus

- Collectors

- Creditors or some combination of the three.

Finding what you want quickly is a breeze in this course.

Detailed Table of Contents: Like all the Modules in the Advanced Credit Course, Credit Repair Tactics features a complete Table of Contents that goes Page by Page so you can quickly turn to the exact section you need at the moment (although it’s highly recommended you read the entire course first).

Contact Info You Won’t Find Anywhere Else: Here’s something that will save DAYS of searching – it may be the ONLY single location where you’ll find complete contact information for.

- U.S. Federal Trade Commission – All regional offices

- State Public Utility Commission Complaint Numbers – All 50 States

- State Chartered Credit Union Regulatory Agencies – All 50 States

- Equifax, TransUnion and Experian

Plus, SIXTY (60) Fully Researched Credit Repair Tactics – from A (Advanced MOV Tactics) to V (Violation Bingo) each with complete description, rationalization and explanation. It’s perhaps the most comprehensive collection of tactics ever compiled by top experts in the field.

Believe it when we say you WILL NOT find a legal tactic

that is not fully covered in this module.

Here’s just a brief sample of the tactics you'll get in module 3

- “Violation Bingo” is a game of catching bureaus, creditors and collectors violating the law so you can create leverage for your client. There are 15 ways to catch them and it’s easy when you use the violation checklists and “bingo sheets” starting on page 34.

- As a credit repair professional you’re going to have clients who have been victims of Identity Theft. Don’t stress. Just help them follow the “6 Simple Steps” on page 139.

- The Omission Technique applies to debt collectors and paid collections where funds were illegally collected under “omission”. How can this technique get money refunded or credit reporting deleted? Answers on page 97.

- Late Pay Catch Up Offer is a powerful technique for remedying late pays with your client however your client must meet four requirements to make it work; details on page 112.

- Collector Continues to Report: After asking for “debt validation”… There are over 10 things you can do but how many of them do you currently know? Page 132.

- The Financial Hardship Tactic is often overlooked, rarely used but can be very effective when your client has multiple late pays. Page 147.

- What is the “Blame Game Tactic” and why is it more often proven to quickly get deletions in a creative way? Interesting story on page 155.

- The “Multiple Disputes Per Item” Strategy offers you up to 19 potential disputes per a single item. How many of them do you currently know? Surprise examples on page 160

- Multi-Letter Shuffle Method: reveals how you can make the credit bureaus technology work against them but you must follow to guidelines before starting which are revealed on page 174.

You’ll also get the lowdown on Medical Collections, the RESPA Strategy, Credit Management, Merged Credit Files, Multi-Letter Shuffle Method, Nervous Nellie Tactic, Multiple Disputes Per Item and something we call the “Joe The Plumber Strategy”

With all these strategies at your fingertips you’ll have a Plan B, Plan C and Plan D to follow. You’ll practically NEVER run out of options (and that spells success!).

Module 3 – Credit Repair Tactics – a $495 Value

I know it seems like we’re throwing a TON of information at you but this is JUST THE TIP OF THE ICEBERG.

We’re talking about a 900-Page Course. And remember, the Advanced Credit Course is NOT an e-book or a CD; it’s six easy to use volumes that you can make notes in, read at the breakfast table, pass around to your employees and keep on your bookshelf for quick reference.

There Are Two Halves to Operating a Credit Repair Business:

- Providing Professional, Effective Credit Repair Services

- Running A Successful Business.

MODULE 4:

Is Everything About Running and Growing a Successful Business

This module is a bonus just filled with the knowledge, strategies, tactics, tools and vital information used by some of the very best and fastest growing credit repair businesses in the market.

- Don’t buy the program for this module alone. We want you focused on using our systems, templates, and answers to become a better more compliant and more efficient credit repair professional.

- When that happens, you enjoy your work more, you have a better work life balance, you’re happier and much more satisfied.

- But we know you! Once you whip your business into shape you’ll want to find out more about what other successful credit repair business owners are doing to run and grow their businesses.

- And while we don’t want to distract you from your core mission, we have included this entire module of bonus materials here for when that happens– and just for you.

Here’s a small sample of that Module 4, Your Credit Repair Business contains:

- Our section on Internet Marketing includes over 12 Core Strategies. If you’ve ever wanted to discover the “overnight way” to learn the internet to market your services this is it. See page 32.

- Podcasts: if you don’t know what “iTunes” or a “Podcast” is then get ready to have trouble sleeping. Why? Because one of the fastest growing mediums on the internet is about to help you build your business. Your wake-up call starts on page 36

- Email Marketing is something to get excited about. Whether you are a new dog or an “old dog” you’re going to learn a lot of “new tricks” starting on page 39

- 19 Great Letters You Can Use! We’ve taken the time to pre-write almost every letter you’ll need in dealing with clients. You can use just 1 or all 19 of them. Details start on page 74

- There are 8 Primary Methods for Marketing Your Services. You don’t need to use them all (but if you do you will be above every one of your competitors). List on page 18

- The Art of Referrals: if you’ve ever been in sales you know cold calling sucks but referrals are easier than talking to friends because referrals result in money. Here’s 7 creative ways to generate them with minimal effort. Page 19

Module 4 – Your Credit Repair Business – a $199 Value

MODULE 5:

Written Communication is The Key to Success in Credit Repair With Module 5

Your Credit Dispute Library – Your letters will gain the professional edge that gets results!

It is often said the art of letter writing was beaten to a pulp by email and finished off by text messaging. The text shorthand “words” LOL, OMG, TMI and BFF are ALREADY in the Oxford English Dictionary! By the way these are not acceptable to use in any business letter! However, if you’re one of those who hate, loathe and despise having to craft any kind of letter, the credit repair business is not for you. Sorry to say,

EFFECTIVE, BUSINESSLIKE LETTERS MUST BE WRITTEN AND MAILED if you’re going to conduct credit repair like a professional.

Luckily, the authors of the Advanced Credit Course recognize this dilemma. They have come to your aid with the ultimate Credit Dispute Library in Module 4.

This invaluable library contains a total of 142 simple, straightforward, detailed, BUSINESS STYLE LETTERS that would impress any creditor, credit bureau or collector. Well maybe not so much the collectors. Cash is often the only thing they like to read.

For quick reference, the “library” is divided into Letters to creditors, Letters to credit bureaus and Letters to collectors

These letters provide excellent examples of the professional style and tone (and even some of the phrases) you need to use in a wide range of specific dispute letter applications (142 to be exact). Feel free to paraphrase them, re-word them and customize them to your particular situation. Knowing exactly how to communicate to your adversary in a tactful, professional and clear manner goes a long way towards gaining respect and, more importantly ACTION!

Here’s Just a Sample of The Letters Contained in Module 5

Incomplete Reporting Of Credit Item – 5 Letters

Incorrect Balance Dispute – 3 Letters

Inaccurate Information Dispute – 3 Letters

Undated Late-Pays On Derogatory Account – 2 Letters

- Escalating Round 2 Dispute of Inaccurate Information – 6 Letters

- Request for Investigation Procedures – 6 Letters

Inquiry dispute – 5 Letters

Confirm Debt Settlement Offer – 5 Letters

KO Collection Letter Example – 5 Letters

…to cite only a few of the available letters.

With 142 Samples and Examples…

you will be able to find a letter for practically any dispute situation you will encounter.

You’ll save hours of time that you don’t have to spend staring at a blank screen and trying to formulate just the right sentences to state your client’s position succinctly and powerfully.

This is the volume you’ll keep at your fingertips every day. Based on thousands of cases successfully resolved by top credit repair professionals and attorneys, you simply can’t go wrong when you use these letters to communicate your seriousness, your professional stance, your knowledge of the law and your unwillingness to go away.

Dispute Library – a $199 Value

The Advanced Credit Course Includes

Module 1 – Credit Repair Basics…………………………………………………………. $199

Module 2 – Credit Bureaus, Collectors and Creditors…………………. $199

Module 3 – Credit Repair Tactics………………………………………………………. $495

Module 4 – Your Credit Repair Business…………………………………………. $199

Module 5 – Credit Dispute Library……………………………………………………… $199

Because this is a COMPLETE course, designed for professional use, it includes a two-volume study guide that gives you and members of your staff the opportunity test their knowledge.

Study Questions (90 pages)

and

Companion Study Question Answers

(Also 90 pages)

Both just $150

THE ENTIRE 6-VOLUME ADVANCED CREDIT COURSE AND STUDY GUIDES

A 900-Page Easy to Use Teaching and Reference Set Compiled and Edited by the Nation’s Foremost Credit and Credit Repair Experts

THE Essential Aide to Any Practicing or Prospective Credit Repair Professional

- A Comprehensive Reference That Covers Any and Every Dispute Situation with Credit Reporting Agencies, Creditors or Collection Companies.

- The Perfect Way to Expand and Then TEST the Knowledge and Understanding of Every New Credit Repair Employee.

- Valuable Contact Information for Dozens of CRAs, State Agencies, FTC offices, FCC offices and Attorneys General

- The Ultimate Guide To What Are Legal, Professional, Ethical and Proper Practices for Credit Repair Professionals

- An Eye-Opening Primer on Marketing, Advertising, and Self Promotion That Can Accelerate Business Growth Tenfold

Can you go ahead without it? Maybe. But why would you?

The 6-Volume Advance Credit Course & Study Guides, purchased individually a $1297 Value

Or

Purchase The Entire Course for JUST.. $497

(plus Shipping and Handling)

YOU SAVE $800!

Extra Study Question Booklets $99 ea

(Only one Answer Book Per Office)

You’re gonna get this secret formula for just

$497!

$697

Think about it… You’ve probably spent $697 $497 on Starbucks, eating out, and other non-essentials in the past month. Why not spend that on something that’s going to make your business money and to help your business to get results… instead of spend it?

And you’re not just investing in the course and what you learn…you’re investing in your business…your future…adding predictability to your results.

So don’t wait: Get started so you can enjoy your new-found business knowledge and results for your clients and yourself!

Advanced Credit Course Appendix

Module 1 – Credit Repair Basics

CONTENT HIGHLIGHTS

- To be a true credit professional you need to know the true definition of exactly what a credit report is. 9 out 10 people in the business get it wrong and it’s costing them but it won’t cost you (after reading page 8)

- Most people doing credit repair can’t correctly answer the following question; “what business are the credit bureaus really in?” The right answer is on page 9

- Learn the two main reasons the credit bureaus dislike credit repair? Sharing the answer on page 11 with new clients will make them love you (and send you referrals!)

- Learn the “magic key” to credit repair which too many people miss? (page 12)

- It’s one of the “deadliest” mistakes you can ever make in credit repair but it costs you ZERO money and effort to avoid it (explained in one paragraph on page 14)

- Before you can become a credit repair professional you must first become a pro on the credit bureaus. Find out the fastest way to do this? ANSWER: Start reading on page 15

- “Metro 2 File Format”, “Matching Algorithms” and “Partial Data Matches”. A true Credit Professional knows all these terms… but you’ll master them in one evening after turning to page 19

- Learn the “Hierarchy of Data Importance?” And why are the social security number and date of birth not required fields for credit reporting? Important answers on page 21

- Who is Leonard Bennett and why if you can’t answer the question you can’t be a credit professional? Wake up call starts on page 22

- Why do so many credit reports have so many errors but very little missing information? The answer is on page 23

- How many E-Oscar codes are there and how do they affect your disputing approach? Important information on page 27

- Is it possible that all supporting evidence, documentation, and valuable reasoning can be translated into a single numerical code regarding a dispute? page 28

- When should you dispute by phone? By fax? By computer? Or by Bureau designed forms? Surprising answers found on page 30

- What is “batch interface” and how can damaging Senate testimony on this technology actually help your business? Page 30

- Why most so-called credit repair professionals do nothing but “bang their heads against the wall” by repeatedly mailing dispute letters to the bureaus and why you should avoid this stupidity. Page 33.

- Why sending a dispute letter labeled “not mine” is not only stupid (but dangerous) for the following four reasons found on page 34

- What are the “three keys” of credit repair you should share with every new client. page 35

- What is the basic “7-Step Credit Repair Process” and when should you have a client call a creditor? Page 36

- Why Factual Disputes so powerful? Why do so few use them and how many ways can they be constructed? Important facts on page 37

- When can removing negative item actually lower your clients credit score? Critical points on page 40

- Bureau Stall Tactics: how many ways can a CRA stall your disputes and how should you respond to each? Page 41

- How long do negative items stay on a credit report? If your answer is “seven years” you are wrong because the dirty inside truth starts on page 42

- If a client chooses to pay collection will it stay on their credit report longer? The answer is on page 43

- There are five “exceptions” to the seven-year reporting rule. Do you know them? You will after reading page 43

- Ignore this “one thing” you’ll be forgetting what affects 50% of your clients credit score. Avoid making the mistake many of your competitors do by reading page 46

- What are “Fico Scorecards” and how can understanding all 10 help you get better results for your clients? Page 47

- Why is it possible to obtain a 700+ credit score only two years after bankruptcy? The secret is revealed on page 49

- Learn the “eight point hierarchy of impact” with regards to negative items and how can it help you? Page 50.

- There are over 100 credit scores on the market but what are the only three scores you need to be concerned with? page 51

- What are the three criteria every dispute must be based upon? Page 57

- What are report codes? How many are there? What do they mean? Page 58

- Missing creditor names, account numbers, incorrect balances and/or credit limits… how should you approach each for correcting or deletion? Page 64

- How can a collection account have a credit limit? Here’s how to capitalize on that mistake. Page 65

- Closed accounts with late pays or undated late pays offer a great “easy” opportunity for deletion. Here’s how on page 66.

- DOLA = Date of Last Activity but “re-aging” is a bigger issue. Do you know the best way to deal with it? Answer on page 67

- Why is the “DU” (Date Updated) so important and why should you pay close attention to it? Page 68

- What are the “7 Points” to prioritizing your clients derogatory items and why is it so important? Page 75

- Learn the “Date Assigned” and why is it so critical when trying to get a collection deleted? Page 81

- Indirect Dispute Tactics: Why are they so unknown? Why are they so powerful? And why are they so controversial? Answers on page 85

- Dispute Letters: Here’s a killer secret to success no one is talking about… Page 88

- Learn about “Code Crafting” and how can it make you a Godsend to your clients? Page 88

- OCR Stands for “Optical Character Recognition” but here is the “12-Step Process” a dispute goes thru which no one talks about… Page 90

- What’s the one mistake you should never make with a dispute letter? Find out on page 92

- What are the “3 elements” every dispute letter must have or the credit bureau can deem your dispute as frivolous? Page 92

- Why should your client never sign a dispute letter going to a collection Agency? Alarming details on page 95

- Killer results begin with killer dispute letters. Do you know the “14-Point Anatomy” of a dispute letter? It’s all broken down for you on page 97

- Correction vs Deletion: do you know the “2-Point Criteria” to determine which is better and when to use them? Page 106

Module 2 – Bureaus, Collectors and Creditors

CONTENT HIGHLIGHTS

Credit Bureaus

- Who are the credit bureaus’ main customers and how can this help you change your strategy to get better results for your clients? Page 11

- FTC Report to Congress: reveals shocking statistics which are secret to 99% of all credit repair companies. Know how to use them to your advantage. See page 12

- What are the 5 most common reasons disputes are flagged as Frivolous and what is the “5-Point Checklist” you must adhere to in order to avoid having your disputes rejected? Page 15

- Frivolous Disputes: if the dispute is deemed frivolous what’s the first three things you should do to keep the dispute moving forward? Page 16

- How understanding the “7-Step Process” every dispute goes through at the bureaus with regards to FCRA Section 611(a)(1) helps your clients get results. Page 17

- If you submit “10 pages of evidence and documentation” to the bureau with a dispute; will your client benefit from this extra work? Answer on page 22.

- eOscar Secrets: Electronic Online System for Complete and Accurate Reporting (aka eOscar) allows the bureaus to respond to disputes with one of 27 codes. But how many can the creditor respond back to the bureau with? Page 23

- eOscar Secrets: how many possible responses can your client receive from the eOscar system and which three are the most problematic to deal with? Page 24

- Learn the most common “barrier” you will encounter when disputing items with the credit bureaus and how should you overcome it. Page 25

- What’s the first thing you should do when a dispute comes back “verified“ from the credit bureau? Page 25

- Disputes with larger creditors should be handled differently than smaller creditors in order to get your client maximum results. Learn why on Page 26.

- Did you know there are over “eight different strategies” you can use when your clients dispute comes back as verified? How many of them do you know? Find the answers on page 27

- What is the “Update Audit Technique” and how does it work? Page 28

- If your disputes are being ignored by the credit bureaus learn the first three actions you should think about taking. Page 29

- Negative items you once got deleted off your clients credit report have now been reinserted … Know the first thing you should do. Page 30

- The FCRA contains something called “Expedited Dispute Resolution.” Is this an option you should use, avoid or ignore? Page 32

- If you make one of these three mistakes it guarantees the credit bureaus will screw your disputes… how many of them are you currently making? Page 33

- Shocking Senate testimony reveals each credit bureau has a VIP Department which gives special treatment to celebrities, politicians, credit bureau employees and anyone of power. Is it possible to use this fact to get results for your clients? Answer on page 35

- Why should you get excited every time you catch the credit bureaus violating your clients rights within the dispute process? Page 36

- Why do credit bureaus commonly send “scary letters” to consumers making them think someone may be tampering with their identity? Inside answers on page 38

- A 2 1/2-year-old charge off was deleted in only 9 days with a creative 100 Word Statement. Learn how on page 39

- Why it is critical your client keeps print copies of their credit reports for seven years. Most people overlook what you’ll discover on page 40

- Why does high-end advanced credit repair require you to work less with the credit bureaus than low-end competitor “McDonalds Style” credit repair companies? Facts on Page 45

Collectors:

- What are the two types of bill collectors and what are the two main ways they obtain debts to collect on? Page 46

- What are the four main tools available to collectors and why is doing a “cease and desist” complete suicide if done the wrong way? Page 47

- What is the “8-Point Checklist” for building a context for a collection account and why is it so important this step is not skipped over? Page 49

- Debt collectors have a bad track record of breaking the law… what are the 13 most common ways they do and how can you use this fact to your advantage? Page 51

- Why would a collector falsely validate a debt (i.e. with an affidavit) and how should you respond when they do in order to achieve an optimum outcome? Page 53

- FDCPA Section 809(b) has clear guidelines about “debt validation” and how collectors must cease all collection efforts until they can provide the consumer by mail 1 of 6 things; what are they? Page 55

- Under the FDCPA collectors are required by law to provide a consumer with written notice containing specific information regarding the consumers right WITHIN 5 DAYS of the “initial communication” in connection with any debt. How do you capitalize on this fact? See page 57

- Chaudry vs Gallerizzo is case law cited by some collectors in an attempt to collect a debt. Why is it important you know that details about this case? Page 58

- What should you do if a client has a single collection account being reported under multiple account numbers on their report? See page 59

- Why “debt validation” is so critical when dealing with collections in regards to Section 809(c) in the FDCPA. Page 64

- There are over 26 ways to catch collection agencies violating the FDCPA in order to help your client get massive leverage; how many of them do you know? Page 67

- Under the FDCPA the “Burden of Proof” is on the collector to show that a debt is accurate and verifiable in order to continue collection efforts and credit reporting. Learn the “5 Elements” that should be verified from original creditor records in the validation process on Page 71.

- Why it is so important the client dispute a debt within 30 days of receiving the original collection notice and can a collection account legally be deleted. Answers on page 73

- Learn the one method used to get many collectors to delete collection accounts but few collectors will ever admit to on page 75.

- What is the most effective collection dispute based on? Simple answer on page 78

- There are “17 Potential Options” for you to exhaust when trying to get a collection deleted. Where do you start? It’s no problem with the steps and diagram beginning on page 83

- If your client has a collection due to Identity Theft what are the critical first three steps they need to take ASAP? They’re listed on page 89

- Know the first of three steps you should do if your client is being ignored by a debt collector? Page 90

- What is the “K.O. Method” for deleting collections? When should you use it and why does it work so darn well when used properly? Page 91

- How does the “Proof of Contract” method work and when should you use it? Page 93

- What if a collector validates a debt? Learn exactly what your next move should be and why on page 95.

- What if a collector responds but does not provide true validation of a debt? Don’t despair; there is an ingenious response tied to the FTC on page 96

- There’s a special way to use the Better Business Bureau when it comes to collections and it can be very effective if you know what you’re doing. Step by step info starts on page 99

- Suing a collector is rare, but there is a time when a client may be better off suing a collector. Here’s a simple and easy way to address this issue which will let you sleep well at night. Page 108

Creditors:

- Direct Disputes: FCRA Section 623(8)(d) outlines direct disputes, but why is it crucial you understand Section 623(8)(g) before you do anything? Page 110

- Is it true there are zero rights for disputes “created or submitted” by credit repair organizations and what exact part of the FCRA covers this? Page 111

- What are the two most important things to know about “direct disputing” and how it applies to other tactics you can use to help your client? Page 112

- Know why you should never dispute with the furnisher of information first and why this not the best course of action. Page 113

- Why is sending a second dispute which is considered “substantially the same” absolute suicide for you and your client? Page 114

- What is the “3-Part Anatomy” of an effective furnisher dispute and why should it always be followed for maximum results? Page 115

- What is the “4-Step Basic Process” to follow for a furnisher dispute and why is the sequence of the steps so important to your clients results? Page 117

- Court Case: why is the case of Johnson vs MBNA so important with regards to furnishers conducting a “reasonable investigation” when you dispute with a creditor or furnisher? Page 118

- Why do credit bureaus want to please banks more than they please you and how you can use this fact to your advantage to get results for your clients? Page 119

- Why are creditor/furnisher violations important and why should you always be on the look to play a game of “violation bingo” for your client? Page 120

- Why should the “Human Factor” never be forgotten when dealing with creditors or furnishers and why should a “goodwill request” never be ruled out as an option for results? Page 121

- What are two things you can accomplish for your client before resorting to Creditor and Settlement Related Tactics? Page 122

- What are three other laws affecting creditors or furnishers which most everyone overlooks for possible leverage for their clients? Page 122

Module 3: Credit Repair Tactics

CONTENT HIGHLIGHTS

- You should know the two most important credit repair tactics (aka golden rules) almost no one talks about but you should never forget. Page 10

- Here is the “Six Point Basic Dispute Process” which should be custom tailored to you and your clients needs. Page 11

- What is the “five point client planning process” you should follow with every new client? Page 12

- Here’s a list of exactly “60 Credit Repair Tactics” a true credit professional understands, but how many do you know? List starts on page 13

- There are 10 indirect credit repair tactics and you are seriously hurting your clients results if you’re not using them. Page 17

- What “subprime merchandise cards” are and the three ways they can help your client. Page 21

- What is the number one “hidden goal” of a subprime, secured or department store card? Page 26

- Why “advanced credit profiling” is it one of the biggest secrets to help your client build credit quickly. Page 30

- What is “Inquiry Bumping” and how does the use of credit monitoring service tie into it for removing hard inquiries from your clients credit reports?

- “Violation Bingo” is a game of catching bureaus, creditors and collectors violating the law so you can create leverage for your client. There are 15 ways to catch them and it’s easy when you use the violation checklists and “bingo sheets” starting on page page 34

- How you can use the “Basic Creditor Verification” method with your client and the “FCBA Wish List” method to get slam dunk deletions for your client. Page 41

- Learn the five-point process of a basic “Method of Verification” request? Page 51

- What is the Squeaky Wheel Method and when are the two times you should absolutely use it for your client? Page 55

- How the FTC can be a useful tool for your client even though it doesn’t intervene directly in consumer cases against creditors, credit bureaus and debt collectors. Page 56

- Telephone, cable and satellite companies are notorious for creating erroneous and bogus debts which they then send to collectors. Learn how powerful a Complaint to the FCC can be in these cases. Page 60

- When you have a legitimate complaint against the bank you can actually leverage the Federal Reserve system for your client. Page 64

- The Better Business Bureau can be a powerful tool to get results for your clients but what are the three biggest mistakes you don’t want to make when using them? Page 71

- What are the “13 Keys” to maximizing successful in leveraging the BBB for your client? Page 77

- Attorney General Tactics: there are two ways AG tactics can be executed. Learn what they are so you can have this powerful tactic in your repertoire. Page 83

- Corporate Officer Tactics: sometimes larger corporations get so big it’s difficult for the people in power to know and understand what is going on right under their nose. This is where corporate officer tactics come in. But what are the three steps to follow when using them? Page 85

- Statute of Limitations can be a powerful tool when dealing with collectors. However, it can also be dangerous. Certain states have a SOL of up to 15 years and there is an important four step process which should be followed; do you know it? Page 87

- The K.O. Technique boils down to one thing: is there a contract that obligates the consumer to pay the debt collector? But do you know the proper way to execute the strategy? You will after reading page 93

- The Omission Technique applies to debt collectors and paid collections where funds were illegally collected under “omission”. How can this technique get money refunded or credit reporting deleted? Answers on page 97

- Pay for Deletion: some collections for smaller amounts, even erroneous ones, are easier to pay and get deleted than to fight over, but there are a few keys you need to know before approaching them. Find out on page 101

- Collector Fails to Delete – even after the debt is paid! What can you do? Three things starting on page 109

- Late Pay Catch Up Offer is a powerful technique for remedying late pays with your client however, your client must meet four requirements to make it work; details on page 112

- Here is the essential six-step process for effective Debt Validation which orders the collector to cease collection and reporting activity. Find it on page 114.

- Collector Fails to Validate: the collectors failed to validate your debt. Now what do you do? Don’t worry, follow the steps starting on page 116

- After requesting “debt validation” the collector continues to report. You MUST KNOW the 10 things you can do. How many of them do you currently know? Page 132

- Collector Responds with Validation: but does this mean success is out of reach? Not a chance! There are over 5 things you can do to keep moving forward for your client. See page 134

- Validation Checkmate Tactic: is best used for older collections and only takes three steps. However, there is one downside you should know before using it. See page 136

- IDentity Theft: as a credit repair professional you’re going to have clients who have been victims of identity theft. Don’t stress. Just help them follow the “6 Simple Steps” on page 139

- Goodwill Request: is simple and easy to use and can successfully correct late pays for your client but they can only be used in certain situations. Details on page 146

- The Financial Hardship Tactic is often overlooked, rarely used but can be very effective when your client has multiple late pays. Page 147

- What is the “Blame Game Tactic” and why is it more often proven to quickly get deletions in a creative way? Interesting story on page 155

- What is the “Angry Educated Consumer” Strategy and what is the key to making it most effective for your client? Juicy details on page 158

- The “Multiple Disputes Per Item” Strategy offers you up to 19 potential disputes per a single item. How many of them do you currently know? Surprise examples on page 160

- Joe the Plumber Strategy: leverages the fact the standard entry for dispute of an item at the bureau only has a section for entering ONE dispute per item thereby they are not conducting a reasonable investigation by not transmitting all data. Page 163

- How would you like to remove all derogatory information being reported on a mortgage for a period of time? With the RESPA Strategy you can… see page 164

- Mortgage Late Pay Wish List Method: did you know there is a “laundry list” of 24 items a mortgage servicer is required by law to provide you within 60 days of asking for them? And, they are forbidden to report any derogatory data until they do? Exciting details on page 169

- Multi-Letter Shuffle Method: reveals how you can make the credit bureaus technology work against them but you must follow to guidelines before starting which are revealed on page 174

- The 2-Year 2-Step Repossession Strategy is an incredibly creative way to utilize consumer protection laws for any auto loan reporting a deficiency balance which greater than 2 years in age. You’ll love this starting on page 175

- Stopping Collector Calls: basic, easy and effective strategies revealed on page 181

- The Nervous Nellie Tactic is designed to trap collection agencies when they violate the FDCPA but in should only be used on debts that are beyond the SOL. Why? Page 182

- The HIPAA Medical Collection Strategy is a powerful technique which is incredibly effective. You must charge accordingly but the results on average will justify themselves. Killer info on page 190

- Medical Collection Trouble? Don’t despair… you may need to file a HIPPA Complaint with the Office for Civil Rights to get your client a deletion. All the details and instructions are on page 212

- Not all late pays are created equal. Some are easy to delete and some should be left alone. Learn how to tell the difference and up to 16 tactics of approaching them on page 220

- Charge-Offs are one of the top three issues a credit repair professional will deal with. Here’s 15 strategies for attacking them. Page 224

- Collections are also in the top three issues you will be helping clients with. Don’t worry. You’ve got 24 techniques available to you starting on page 226

- Bankruptcy: over 50% of all bankruptcies on credit reports contain errors. There is a huge opportunity in helping clients with this one issue. Here is a “3-Point Plan” to get started with on page 231

- Foreclosure is a complex process entangled in numerous laws and regulations which are prone to errors. Of course, this spells opportunity for you and your clients. 17 strategies apply starting on page 233

- Repossessions: there is a 7-Step Process you should follow with any repossession. It is simple and powerful. Do you know it? Details on page 235

- Some tax liens can be removed and others cannot. Knowing the difference can make you a hero in the eyes of your client. Start on page 237

- Inquiries are a real score killer but you can help your client by starting with the 8 Tactics listed starting on page 240

- Mixed or Merged Credit Files: This is a common issue with clients. Solution can be found with 7 techniques starting on page 241

- Credit Management: is one of the most overlooked untapped strategies where credit professionals can make easy gains for their clients. An entire section is devoted to this subject which begins on page 243

Module 4: Your Credit Repair Business

CONTENT HIGHLIGHTS

- Want to build the most profitable and sustainable long-term business you can? The key to your success lies in answering the “Four Positioning Questions” found on page 11

- 19 Great Letters You Can Use! We’ve taken the time to pre-write almost every letter you’ll need in dealing with clients. You can use just 1 or all 19 of them. Details start on page 74

- How much should you charge?: the answer to this question is easy to determine once you address the “5 factors” listed on Page 87

- Problems with Payments: many credit repair companies don’t know how to deal with certain “problem customers”. Avoid all these issues by following the “5-Step Plan” on page 90

- Office Secrets Revealed: did you know there’s a few secrets to setting up your office which can put thousands of dollars in your pocket with almost zero effort? Most people don’t and that’s why the info is so important on page 93

- Organization Secrets: have you ever walked into a cluttered room? How did you feel? How did you feel when you were done organizing it? This is why this section is so important (when you feel better you make more money). See page 95

- Software Solutions: when your business is ready then you’re ready for a credit repair software solution. Streamline it all and enter the big leagues on Page 98

- Laws and Compliance: there are 5 cardinal rules you must practice in your business and laws and compliance are just a part of that. No stress. No worry. Just follow the rules starting on Page 101

- Prohibited Practices: no course would be complete without what covering what NOT to do. So simple a 12 year old could understand. Details on Page 108

- Disclosures: did you know there is a special disclosure form all new clients must “sign off” on before agreeing to do business with you? No big deal and no sweat. It’s reprinted for you on Page 110

- Contracts: you need to have a contract with your client. No need to write one as you can use the on provided on Page 112.

ADVANCED CREDIT COURSE Is Guaranteed To Work For You, Improving Your Business Knowledge and Systems and Results … Or It’s FREE!

Now, I have NEVER once sold ANYTHING without a proper guarantee.

And ADVANCED CREDIT COURSE is no exception, rather, it’s THE answer to improving your current credit repair business or to helping you to get yours off the ground. It is the learning resource.

And to those who are just getting started: Advanced Credit Course will absolutely SAVE you from the headaches of trial and error.

But if you just don’t see the value in these 6 Volumes of “real-life” knowledge, answers and templates you are welcome to return it within 90 days for a full and fast refund.

That’s right, you have 90 days to implement the tools included in this content-rich program.

And if for some reason, or no reason at all, you are NOT convinced that Advanced Credit Course is working for you and getting the information AND results you need, then just call 727-842-9999 and we will issue a refund with no questions asked.

Even if you wake up on the wrong side of the bed one day and decide to send it back, you can… just call.

The reason I can offer such a generous guarantee is because I am SO confident that if you take action on the secrets in Advanced Credit Course, you’ll get your investment back and will want to refer to this program again and again!

You Can Settle For “So-So” Results In Your Business…

Or You Can Take Action RIGHT NOW!

You know as well as I do… winners take action! Losers don’t… and that guarantees their losing streak will continue.

Every time you send out a letter, answer a client’s question or take any action, you are sending out a “mini salesperson.” And don’t you want your salespeople to be top-notch?

Your actions and work product are the conduit that connects your product or service to your prospects. Miss the mark, and it doesn’t matter how “great” your product or credit repair service is…you’ll get extremely frustrated and might even throw in the towel and give up.

Remember, you have NOTHING to lose here. You get 90 days to use the course and to implement any of the materials into your business. And if you don’t make your money back in that time…or even in a month…then you can send it back.

This course and these materials aren’t going to take much of your time but may be just what you need to expose the “holes” in your business systems…

…holes that could be costing you money now and in the future.

C’mon… take an hour to go through it. That hour could lead to a HUGE business knowledge and results windfall for you.

And let’s face it…what you don’t know…you don’t know.

But I do… And those decades of wisdom are shared with you in ADVANCED CREDIT COURSE.

So who from the movie Glengarry Glen Ross are you going to be…Ed Harris’s character Moss who drives a Hyundai to and constantly questions his status and doubts himself…

…or Alec Baldwin’s character Blake…tough-talking and confident…who makes $970,000 and drives an $80,000 BMW….

…and has the selling chops to bank $15,000/night with even the worst leads?

This course is designed to help you to become a better business owner – to be complaint with the rules, and to get better results for your clients – faster than you can now.

Hit the “GET STARTED NOW” Button to get started with ADVANCED CREDIT COURSE and see for yourself how improved copy can help you convert better, gaining you more customers, clients, and patients…and CA$H!

Yes I Want To Spend As Little As An Hour Improving My Business And To Start Learning What I Don’t Know To Start Getting Better Results!

- I realize that having and using systems and templates rather than starting from scratch is one of the best skills I can have as a business owner and entrepreneur…and I need to at least know the “basics” and beyond about Credit Repair and compliance so I can do a great job and to build my credit repair business into a successful business.

- I know that I’m tapping into your decades of experience with this course…and I won’t have to go through the same trial, error, and heartache you had to go through to discover these secrets.

- I also know that I have 90 days to use ADVANCED CREDIT COURSE— and see for MYSELF. And I know I can always return for a FULL REFUND for any reason at all!

- …. I’m ready! Please ship me my copy so I can spend a few hours investing in the future of my business–adding predictability and certainty like I’ve never had before!

Dedicated To Your Credit Repair Business Success!

P.S. 98% of people (that includes your competition!) will NEVER discover the templates, knowledge, tools and secrets in this course and fewer yet will ever implement them. Don’t be one of the 98%—take action today and claim your copy of ADVANCED CREDIT COURSE and be on your way to having the answers you need in the business you want.

P.P.S. Oh and another thing… If you’re thinking these strategies won’t work for your business… that your business might be “too different” from the “Real-Life” scenarios used in this course, you might be limiting yourself. So if you’re in the Credit Repair business, you’ve GOT to have this!

P.P.P.S. And remember, your purchase is completely backed up by my very generous 90 day guarantee. It’s like getting to review this powerhouse program for FREE! Try it, and if you don’t get your money’s worth in the first run through just call 727-842-9999 and you’ll receive a full refund… It’s that simple!